Black Friday, one of the most significant shopping events of the year, brings massive deals, impressive discounts, and sales events. Online retailers and in-store shopping, each with its unique strategies, play crucial roles in this annual retail bonanza.

To show you just how impactful this shopping weekend is, we’ve gathered quite a few interesting holiday shopping statistics around Black Friday. Get curious!

Importance of Black Friday

Black Friday has evolved into the unofficial kickoff of the holiday shopping season, significantly influencing consumer spending patterns. No longer just a single-day event, it has become a multi-day shopping holiday with retailers offering extended deals and promotions.

Black Friday’s impact as a shopping event is undeniable. In 2024, Black Friday sales figures reached a record $10.8 billion* in online sales alone, with an estimated 169 million* shoppers participating in the deals frenzy across the US.

These figures highlight the continuing importance of Black Friday for both consumers and businesses.

Online Sales vs. In-Store Sales Trends Over Time

Black Friday’s digital dominance continued in 2024, with global online sales surging by 5% year-over-year to reach a staggering $74.4 billion*. In contrast in-store foot traffic on Black Friday fell 3.2% in the US.

Mastercard also reported a 14.6% growth in online sales in the United States compared to a meager 0.7%* increase for in-store sales.

The message is clear: consumers are increasingly motivated to buy online, drawn to the convenience and competitive online deals available.

Top Black Friday Statistics

The Black Friday shopping frenzy just keeps getting bigger and better each year, bringing along some truly eye-popping Black Friday stats that show how crucial it is in the retail world.

Whether you prefer to shop online or shop in-store, the data reveals trends that everyone in the retail industry can take advantage of.

Black Friday Sales Growth Over the Years

According to market analysis, Black Friday sales have shown significant growth over the past decade, with online sales reaching record highs each year. In 2020, U.S. Black Friday online sales alone surged to $9 billion, reflecting a 21.6% increase from the previous year.*

Spending analysis by year also shows a steady increase in consumer spending. In 2024, the average consumer spent $340.93 on Black Friday.* This data reflects the growing economic impact of these sales events.

Conversion Rates on Black Friday

Shopify data reveals that the average conversion rate for online stores during Black Friday is 4.3%*, significantly higher than the annual average of 2.5%, demonstrating the effectiveness of targeted promotions for holiday shopping.

Although mobile shopping is rapidly gaining popularity, desktop remains more effective in terms of conversion rates, achieving 6.5% compared to 3.2% for mobile.*

Black Friday Consumer Behaviour

A Deloitte survey indicates that 80%* of consumers planned to make Black Friday purchases in 2024, with 57% focusing on purchasing electronics and 77% targeting clothing and accessories.

Here’s a bigger picture of what American Black Friday shoppers bought in 2023*:

- Christmas presents for friends and loved ones – 62%;

- Necessary purchases (food, clothing) – 43%;

- Gifts for friends and loved ones – 42%;

- Spontaneous deal grabbing – 42%;

- Self-gifting – 36%;

- Essential purchases for the home –35%;

- Birthdays and other gifting occasions – 26%;

- “I won’t buy anything over Black Friday” –12%.

Interestingly, Black Friday is becoming increasingly less of a uniquely American phenomenon. With 15%* of global orders now being cross-border sales, its popularity is extending far beyond U.S. borders, becoming a truly global shopping event.

There’s also a push from B2C into B2B according to the latest B2B ecommerce trends.

Black Friday Sales Statistics

In 2024, Black Friday sales numbers and revenue data showed that online retail sales hit a record $10.8 billion. To compete with rivals, some businesses are extending Black Friday deals throughout the week, leading to a more gradual shopping rush. In fact, by the Monday before Thanksgiving, over 40%* of email campaigns promoted Black Friday discounts, securing sales ahead of the holiday rush.

This is how the interest in Black Friday sales across the week looks like globally*:

- Monday – 8.2%;

- Tuesday – 9.3%;

- Wednesday – 11.1%;

- Thursday – 20.8%;

- Friday – 33.4%;

- Saturday – 10.9%;

- Sunday – 6.0%.

Email marketing is a whole lot easier with Sender. Sign up for a free account and create a stunning Black Friday email campaign in under an hour.

Learn more about email personalization: Guide to Personalized Email Marketing.

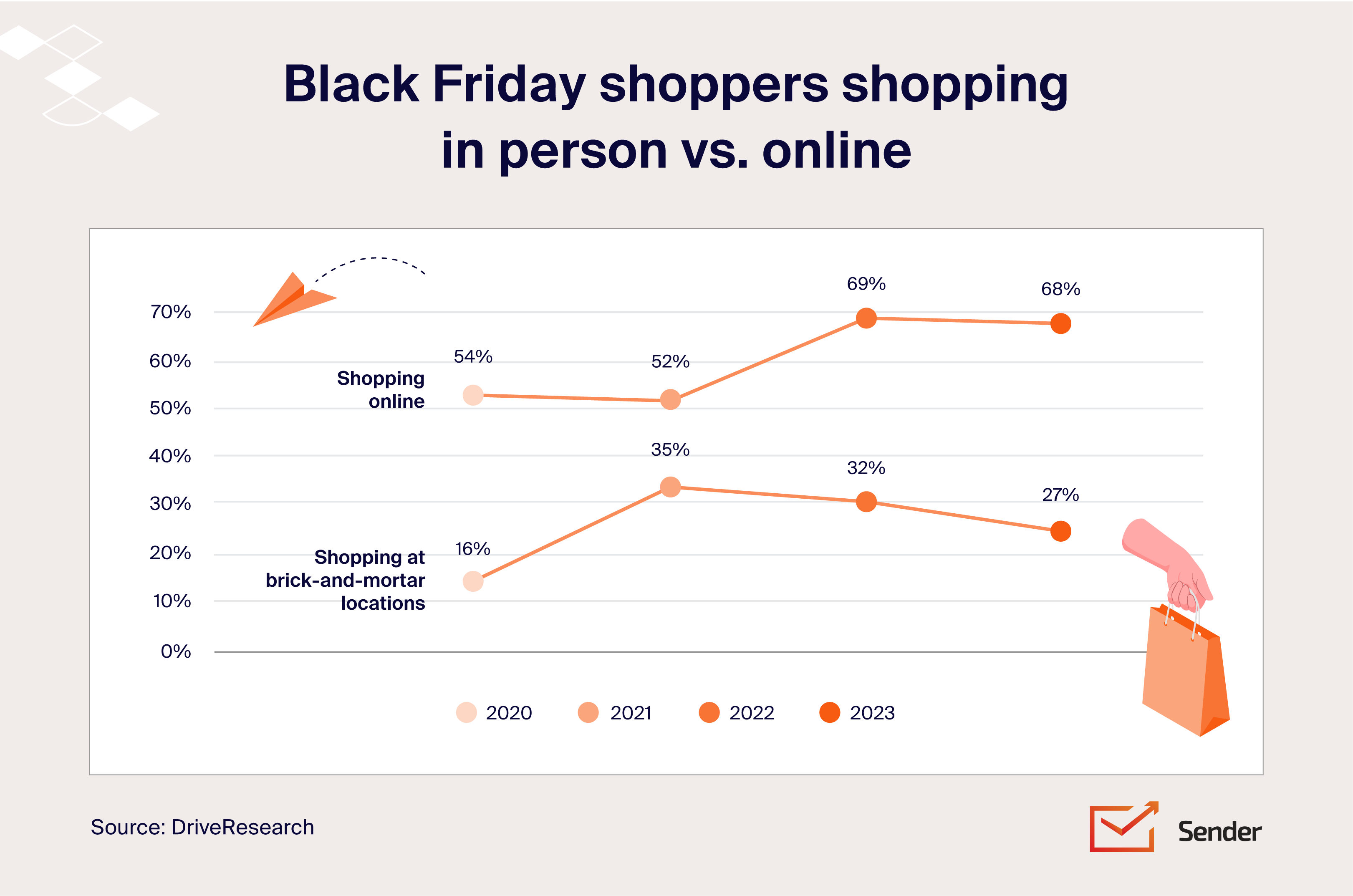

Online Black Friday Sales

Online shopping continues to dominate Black Friday sales. In 2022, online sales accounted for nearly 70% of all purchases (compared to 54% in 2020), demonstrating the shift towards ecommerce.*

Mobile devices also played a crucial role, with mobile sales contributing to 54% of online revenue.*

Black Friday Shopping Statistics

A closer look into shopper demographics has shown that Generation Z and Millennials are particularly active during Black Friday, with only 9% not planning to participate.

Despite their enthusiasm for the sales, it’s worth noting that many shoppers, regardless of age, were left underwhelmed by the average discounts offered.

In fact, according to Black Friday vs Cyber Monday Statistics, a significant 59%* of consumers reported being dissatisfied with their shopping experience, citing unattractive discounts as the primary reason.

Furthermore, a growing skepticism towards the authenticity of Black Friday deals is evident, with 62%* of Americans believing that the discounts offered during this season are simply a marketing ploy, rather than genuine savings.

Black Friday Ecommerce Stats

Black Friday ecommerce growth is rapid and ever-changing. Online retail reports for Black Friday indicate that 55%* ecommerce traffic originated from mobile phones in 2024, highlighting consumers’ preference for browsing and purchasing on the go.

This aligns with the fact that 42%* shoppers find apps more appealing than mobile websites, even for filtering products.

This shift to mobile is also likely driven by consumer desire for convenience and efficiency. Less than a third* of US consumers planned to brave physical stores for past Black Friday purchases, with nearly half citing overcrowding as a significant deterrent.

Interestingly, while social media remains a popular discovery tool for best deals (48%)*, direct website traffic saw an uptick in 2023, with almost 19%* of shoppers heading straight to company websites.

This suggests that cultivating brand loyalty and strong online visibility is crucial for capturing those looking to bypass general search engines and social media feeds in their search for the best Black Friday and Cyber Monday sales.

Shopify Black Friday Statistics

With $11.5 billion* in Black Friday revenue, representing a 24% year-over-year (YoY) increase, Shopify merchants shattered records this BFCM weekend, demonstrating the continued strength of ecommerce.

This success translated into a record-breaking 76 million* global consumers purchasing from Shopify-powered brands, with a peak sales rate of $4.6 million per minute*.

Amazon Black Friday Statistics

In 2024, Amazon announced 12 days of deals from November 21 through Cyber Monday. The event broke records once again, with small and medium-sized businesses driving more than 60% of total sales.

Electronics, toys, and beauty products dominated shopping lists, while strong demand for fast shipping and easy returns fueled a sharp rise in repeat purchases.

Average Black Friday Discounts

Speaking of Black Friday discounts, overall, shoppers enjoyed an average discount of 26%* globally, and 28% in the US, both down 1%* compared to 2023.

Top global average discount rates included:

- Makeup (40%)

- General apparel (34%)

- Skincare (33%

Black Friday Shopping Trends

Though not completely unforeseen, Black Friday shopping trends are gaining speed:

Mobile Shopping Trends on Black Friday

Mobile shopping is on the rise, with mobile devices accounting for 55% of online sales in 2024.* This trend emphasizes the need for mobile-optimized shopping experiences to capture a significant portion of Black Friday revenue.

During the holiday season, we witnessed the impact of SMS firsthand, as well. Black Friday weekend saw a 34%* surge in messages sent as businesses used this channel to reach customers with timely promotions and offers. Moreover, in the week leading up to Black Friday, SMS message volume increased by 14.8%*.

Trends in Black Friday Advertising Spend

Advertising spend during Black Friday has seen substantial increases. Black Friday 2024 saw a big jump in advertising, with retail media ads almost doubling (+92%)* and social media ads rising 35% as brands competed for shoppers’ attention.

Cyber Monday Sales Influence on Black Friday

Cyber Monday has been surpassing Black Friday in recent years. In 2024, Cyber Monday hit a record $13.3 billion in sales, compared to $10.8 billion on Black Friday, while the entire Cyber Week totaled a staggering $41.1 billion*. This trend continues to grow, with many consumers now preferring Cyber Monday deals online.

In general, online sales remain the king of BFCM sales, surpassing other shopping destinations*:

- Online – 44%;

- Grocery stores and supermarkets – 42%;

- Department stores – 40%;

- Clothing and accessories stores – 36%;

- Electronics stores – 29%.

Historical Spending Trends

Analyzing historical sales and spending trends reveals significant increases in Black Friday sales. For instance, the online sale of toys increased by 285% on Black Friday compared to a normal day, while sales of audio and electronic equipment saw a 200% rise.*

Here’s what Americans said they’ll buy during Black Friday in 2024*:

- Clothing – 60%

- Tech products – 54%

- Gifts – 48%

- Accessories (e.g., shoes, bags, jewelry) – 39%

- Toys – 21%

- Beauty and personal care products – 27%

- Household appliances – 24%

Effectiveness of Email Marketing for Black Friday

Email marketing remains a powerful tool for Black Friday promotions. Campaigns targeting past purchases can significantly boost conversion rates and overall sales. Personalized emails with tailored discounts see higher engagement and purchase patterns.

Is email marketing effective during the holiday season? The open rate increased by 44%, and the click-through rate surged by 23% compared to regular email campaigns.*

Social Media Influence on Black Friday Shopping

Social media platforms play a crucial role in Black Friday shopping. Approximately 42% of online shoppers discover deals through social media ads and influencers.*

However, social media’s influence on Black Friday is debatable as it drives only an average of 5%* of total sales on Black Friday and Cyber Monday.

Impact of Black Friday on Small Businesses

According to holiday shopping statistics, Small businesses also benefit from Black Friday (including Small Business Saturday), with many reporting a 20% increase in sales during the Black Friday weekend.*

Top-Selling Products on Black Friday

The National Retail Federation highlights that electronics, clothing, and toys are the top product categories during Black Friday, with 57% of consumers looking for deals in these areas.*

For example, in 2024, clothing and accessories accounted for 49% of sales, followed by toys at 31%.*

But wait, there’s more! Check out these great articles to improve your holiday marketing game:

- Black Friday Marketing: 16 Strategies to Skyrocket Sales

- 22 Black Friday Email Examples to Help You Stand Out

- 65+ Online Advertising Statistics (Facts and Figures for 2025)

*Sources:

- https://www.demandsage.com/black-friday-statistics/

- https://www.statista.com/topics/8714/black-friday-worldwide/

- https://www.activecampaign.com/blog/black-friday-statistics

- https://www.shopify.com/blog/email-marketing

- https://www.campaignmonitor.com/blog/email-marketing/cyber-monday-quick-facts-and-how-to-update-your-marketing-strategy/

- https://www.finder.com/credit-cards/black-friday-statistics

- https://www2.deloitte.com/us/en/pages/about-deloitte/articles/press-releases/black-friday-cyber-monday-embraced-as-consumers-seek-deals-to-stretch-their-budgets.html

- https://dotdigital.com/blog/black-friday-cyber-monday-stats/

- https://news.adobe.com/news/news-details/2023/Media-Alert-Adobe-Cyber-Monday-Surges-to-12.4-Billion-in-Online-Spending-Breaking-E-Commerce-Record/default.aspx

- https://cdn.statcdn.com/Infographic/images/normal/31282.jpeg

- https://www.statista.com/statistics/247204/online-shopping-cart-conversion-and-abandonment-rate-on-black-friday/

- https://black-friday.global/files/x-default/infographics/1-interest-in-black-friday-sales.png

- https://www.tidio.com/blog/black-friday-trends/

- https://wisernotify.com/blog/black-friday-stats/#online-vs.-in-store-sales-over-time

- https://www.shopify.com/news/shopify-merchants-drive-record-high-9-3-billion-in-black-friday-cyber-monday-sales

- https://growthdevil.com/amazon-black-friday-statistics

- https://www.mobiloud.com/blog/black-friday-statistics

- https://business.adobe.com/resources/holiday-shopping-report.html

- https://statistics.blackfriday

- https://retailnext.net/press-release/early-data-u-s-black-friday-in-store-traffic-down-3-2-yoy

- https://www.pymnts.com/study_posts/sales-not-sentiment-drives-black-friday-turnout

- https://www.dhl.com/global-en/microsites/ec/ecommerce-insights/insights/reports/2025-black-friday-trends.html

- https://www.digitalcommerce360.com/article/black-friday-ecommerce-sales/

- https://www.shopify.com/news/bfcm-data-2024

- https://www.salesforce.com/news/press-releases/2024/12/04/cyber-week-ai-sales/

- https://skai.io/blog/black-friday-2024-analysis/

- https://news.adobe.com/news/2024/12/120324-adi-cyber-monday-recap

- https://business.yougov.com/content/50613-us-black-friday-cyber-monday-report-2024

- https://press.aboutamazon.com/2024/12/amazons-record-breaking-black-friday-week-and-cyber-monday-deal-event-was-its-biggest-thanksgiving-holiday-shopping-event-ever

- https://nrf.com/media-center/press-releases/197-million-consumers-shop-over-thanksgiving-holiday-weekend

- https://www.deloitte.com/us/en/about/press-room/deloitte-black-friday-cyber-monday-spending-expected-to-reach-new-highs.html

- https://www.klaviyo.com/bfcm/email-marketing-strategy