Repeat customers are the backbone of many businesses.

Most businesses prefer keeping existing customers at all costs over gaining new ones. Long-standing business research has shown that acquiring a new customer can be five times as expensive!

Therefore, it’s no surprise that many businesses have been looking into strategies that help them create repeat customers that keep buying.

However, we should first describe repeating customers and their benefits to implement these strategies correctly.

Repeat Customer Definition

Repeat customers (or recurring customers) have purchased from your business numerous times. They are differentiated from return customers and loyal customers.

The former are those who returned to make another purchase at a later date but do not tend to do so repeatedly.

Loyal customers will choose your brand time and time again over competitors even if they haven’t even tried other products on offer.

What makes a buyer become a loyal repeat customer is an incredibly wide topic. However, the basics of it are, depending on the business model, excellent customer service teams and overall experience, great prices, and customer loyalty programs.

Of course, more repeat customer spending is better for retail and ecommerce businesses. Shopify recommends that profitable, well-established ecommerce companies focus on retention over acquisition.

However, focusing on acquiring more repeat customers results in relevance in all industries and business models; therefore, even if you are not in ecommerce, there’s a lot you can learn.

Existing Customers vs. Loyal Customers

Loyal and existing customers are similar in that they both have a history of purchasing products or services from a particular company. However, there is a key difference between the two loyalty.

Existing customers are simply customers who have purchased from a company at some point. They may continue to do business with the company, but they are not necessarily loyal to the brand. They may be open to considering other options and could switch to a different company if they find a better deal or more appealing products or services.

On the other hand, loyal customers are more committed to a particular company and are less likely to switch to a different brand. They may have a strong emotional connection to the company and its products or services and may be willing to pay a premium for the quality and value it provides.

Shortly, loyal customers are a subset of existing customers with a stronger commitment and dedication to a particular company and its products or services.

Repeat Customer & Customer Retention Statistics 2025

Before moving ahead, look at some customer retention and repeat customer statistics. Because the thing is — it’s good to measure, quantify, and analyze a problem before starting to find a solution. So, let’s go:

Customer Retention and Loyalty Programs

- 22.8% of the total marketing budget* is allocated to customer loyalty program management and CRM;

- 93.1% of companies that offer a rewards program and measure return on investment have a positive ROI;

- 45% of consumers* stay loyal to their favorite brands due to discounts, regular rewards, and regular incentives. So, an average customer retention rate can be pegged around this for a brand offering such incentives;

- 23% of consumers stay loyal to a brand because they love and trust a particular brand;

- 54% of companies* obsessed with customer service experience higher customer retention from omnichannel marketing. 62% of the companies also register higher margins.

Customer Retention and Revenue Growth

- Loyal customers are worth 10x more* than their first purchase for a business, increasing the importance of average customer retention rates;

- Current customers are 50% more likely to try out new products;

- There’s a 67% increase in spending by a customer in their 31st to 36th month with the brand;

- Customers have a 27% chance of returning after the 1st purchase, 49% after the 2nd, and 62% after the 3rd*;

- The top 10% of customers spend 2x more per order than the lower 90%, while the top 1% spend 2.5x more than the lower 99%;

- Existing customers are likely to spend 67% more* than new customers.

Customer Churn Statistics

- Preventable customer churn costs $136 billion annually* to US-based businesses;

- Customer churn can be reduced by 67%* if businesses solve customer issues during the first interaction;

- Reducing customer churn from 2.5% to 1%* will double your customers within eight years.

Customer Service Experience & Retention

- 74% of customers* will likely purchase based on buying or customer interaction experience. 77% think customer experience is as important as product or service quality;

- 50% of customers* switch to a competitor after one poor customer service experience/ The churn increases to over 80% after more than one bad experience;

- 58% of customers* don’t bother giving a second chance to a company after a negative experience or reaction;

- Only 1 in 26 customers* makes a complaint when they are unhappy. All others churn without complaining or providing any feedback;

- 69% of consumers* shop more frequently at retailers with consistent customer service;

- A happy existing customer is more keen and willing to upgrade or convert via an upsell package or new product launch campaigns;

- 66% of consumers terminated their relationship with a business due to poor customer service;

- When customer service provides value, there’s an 82% probability* of repurchasing or renewal from the customer.

Customer Retention Statistics by Industry

- In some global markets, the average customer churn rate can be as high as 30%*;

- In the financial industry, a 5% increase* in customer retention increases the profit by more than 25%;

- The financial and credit sector has the highest churn rate of 25%*, followed by general retail (24%) in the US.

Customer Acquisition and Retention Statistics

- Customer acquisition costs have increased by nearly 60% in recent years. Most companies lose $29 for every new customer acquired;

- Email marketing is the most effective customer retention medium.

The statistics show that customer lifetime value rises exponentially if customers become repeat or loyal customers. So, building customer retention strategies to nurture long-lasting customer relationships is the best way to grow a business.

Repeat Customer – Goals & KPIs

Every good strategy starts with measuring the progress and efficiency of processes. If you’re wondering how to make customers return to your website or ecommerce business, then you will have to implement the tracking of specific metrics.

Customer Retention Rate

Straightforward and simple. You will always measure customer retention rate as it’s the foundational metric. Of course, there are other metrics you will be tracking. However, the rest of the metrics mostly support customer retention rates and allow you to understand them better.

To calculate the repeat customer rate, there’s a handy formula you should use:

Customer Retention Rates = ((NCE – NEW) / NCS)) X 100

- NCE – Number of customers (over a time period).

- NEW – Number of new customers over the same time period.

- NCS – Number of customers at the start of the same time period.

Customer Churn Rate

If you run an ecommerce or retail business, you’re likely already calculating some form of churn rate. If not, a short version of churn rate is essentially the number of customers you lose over time.

A rule of thumb when aiming for a good churn rate is to keep it below 5%. All businesses have some churn; however, if you’re consistently above 5 or 7%, you should be delving deeper into why it’s so high.

However, there are numerous ways to calculate the churn rate. Depending on who you ask, they might provide you with a more or less complicated formula. The easiest way, however, is:

Churn Rate = Number of Churned Customers / Number of Total Customers

Considering more granular metrics, consider time periods, quarters, sample sizes, and many more factors. Even customer segments might churn at different rates.

If you are looking for more granular metrics, consider periods, quarters, sample sizes, and many more factors. Even customer segments might churn at different rates.

Repeat Purchase Ratio

Repeat purchases ratio is a good way to gauge the number of loyal customers over one-time customers. Of course, you will never know exactly when is the last time someone decided to buy from you, making the ratio slightly skewed. However, the metric is still great in and of itself.

Calculating the repeat purchase ratio is actually quite simple:

Repeat Purchase Ratio = NRC / NTC

- NRC – Number of returning customers (over some time).

- NTC – Number of total customers (over the same time).

It’s generally considered a strong indicator of customer loyalty. You want to get it as high as possible as long as it doesn’t harm NTC.

Repeat Customer Rate

The repeat customer rate is useful for companies to track because it can provide insight into customer loyalty and satisfaction. A high repeat customer rate can indicate that customers who’ve purchased and are happy with the products or services they are receiving are likely to continue doing business with the company. On the other hand, a low repeat customer rate may indicate that customers are not satisfied with their experiences and are less likely to return in the future.

To increase the repeat customer rate, companies may focus on improving the quality of their products or services, providing excellent customer service, and offering ongoing support and value to their customers. By cultivating loyal customers, companies can potentially increase their profitability and reduce their marketing and acquisition costs.

Net Promoter Score – NPS

Most of us have run into NPS, even if we don’t know what it stands for. Suppose you’ve received a request to rate how likely you are to recommend the business to someone else from 1 to 10 after a purchase or a customer service event. Such a request is for the company to collect data to measure the net promoter score.

NPS is another strong indicator, although auxiliary, of customer loyalty. A high number of promoters means that people are likely to recommend your business to others. Of course, that also generally means that they will repeat customers.

To calculate NPS, you must collect data by implementing a survey or questionnaire after relevant customer interactions. However, the NPS data has to be normalized on a scale of 1 to 10.

After collecting the data, all you need to do is plug in a couple of numbers:

Net Promoter Score = % of Promoters – % of Detractors

- Promoter – Gave a score of 9 or 10.

- Detractor – Gave a score of 6 or less.

Active User (Changes)

Finally, a metric you should be tracking that requires no formula – daily, weekly, and monthly active users. Unlike with other metrics, there’s not a lot to calculate here outside of the delta (the changes over time periods).

Of course, you want to keep the average number of active users increasing steadily. However, outside of that, it’s highly recommended to track behavioral statistics to get a better understanding of what your users are doing.

If you track activity closely, you might discover when you need to start re-engaging your users.

How to Make Customers Keep Coming Back?

As repeat customers are such an integral part of retail and ecommerce, these industries have developed many best practices over the years.

Luckily, even if you aren’t in these industries, you can easily use most of the best practices and have customers keep coming back.

1. Start Customer Retention Programs

A classic lesson we can learn from ecommerce and retail is to implement loyalty programs that reward customers for repeat purchases. While these are not the sole reason your customers will keep returning, they’re a great starting point.

For example, if you sell a similar service for a similar price as your competitors, small benefits from loyalty programs might tilt the scales just enough. Additionally, it may give them a better reason to continue buying from you, even if your products aren’t essential.

Finally, another way to implement a loyalty program is to create a VIP discount club. Of course, you must segment customer audiences carefully, but those people will appreciate being in an exclusive club.

2. Focus on Customer Service

If you’ve ever dealt with Amazon customer support, you might have noticed one particular message that appears after you finish the conversation – “the Earth’s most customer-centric company.” Amazon puts great emphasis on providing great customer service.

As they are an extremely established ecommerce company, we can deduce they heavily focus on retention and that customer service is part of their strategy. Brands with superior customer experience generate up to 5.7x* more revenue than competitors that lag in that aspect. So invite changes if needed.

3. Collect In-Depth Feedback

There’s no better source of information on how your business is doing than the customer. However, many businesses only collect customer feedback from reviews and comments, which causes data to skew.

Establishing an in-depth feedback collection strategy is the way to ensure that customers keep coming back. Usually, this will involve using emails to send surveys and, sometimes, rewarding those who have finished them. Of course, you must act upon the customer feedback, but simply implementing a collection strategy is a great start.

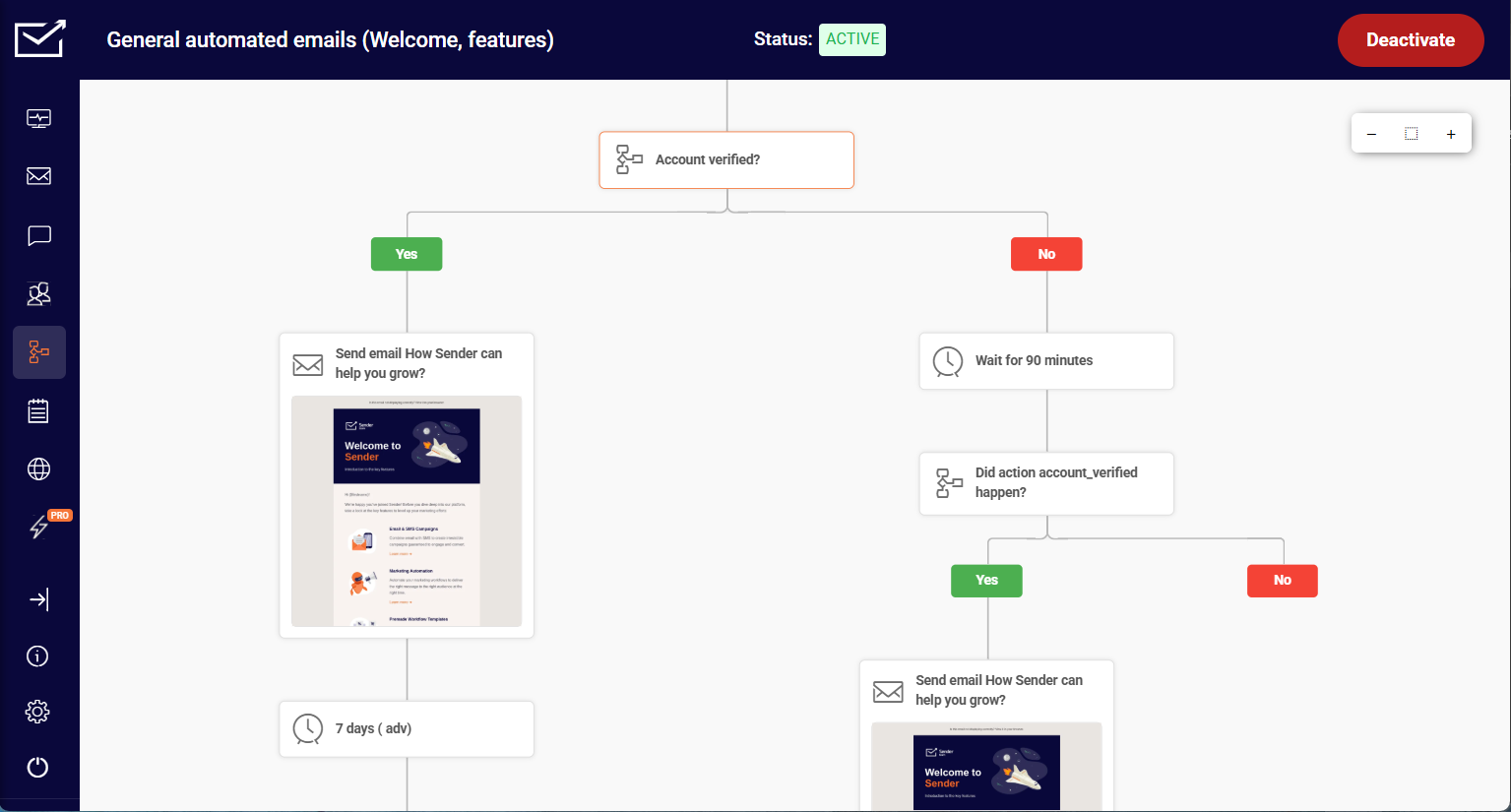

With Sender’s automation feature, create automated feedback emails based on a particular event, e.g., after a purchase. With a user-friendly interface, the setup process is simple.

Here’s a sneak peek of the automated workflow:

Also read: How To Ask For Customer Feedback

4. Send Triggered Emails

An old marketing strategy was to always stay on the customer’s mind. Some salesmen even gave branded calendars as gifts to make the logo and company visible.

Triggered emails can serve the same purpose, except in a significantly better manner. They have the added benefit of being partly personalized. Therefore, customers will pay more attention to triggered emails.

There are numerous ways to approach triggered emails, each depending on the industry. However, the most popular triggered emails are:

- Abandoned cart emails (for eCommerce and retail);

- Reactivation emails (after a period of inactivity);

- Personal event emails (on holidays or birthdays);

- Promotional emails.

Of course, you can include many more triggered emails and customize them according to your industry standard.

Recurring Customers as Recurring Revenue Model

Recurring clients means recurring revenue, which can be the foundation for a profitable business. The most successful businesses make it easy for customers to buy from them repeatedly. Recurring revenue can be as simple as one-off payments, including subscriptions and memberships.

If someone purchases something from you and continues buying from you after that initial purchase, they’re part of your recurring revenue stream. A regular revenue model is much more predictable than a one-time revenue business. You know what to expect from your customers and how much it costs to serve them. You can also plan for the future by investing in infrastructure and hiring employees.

Why Recurring Revenue Matters?

Online businesses can be less customer-centric because they don’t have physical stores and inventory costs like brick-and-mortar businesses. However, this can lower the quality of customer service and less customer loyalty.

Recurring revenue models are a great way to increase the value of your business by creating ongoing relationships with your repeat buyers. These relationships make it easier for you to retain their business and increase their lifetime value — which means more money in your pocket!

The most important thing about recurring clients is that they’re predictable. You know exactly how much money will come in every month (or week or day) because it’s set up as a subscription service or membership site where people pay for access to something (like an online course).

The other advantage of recurring customers is that they provide consistent income. You can plan and know how much cash flow will come every month (week or day). It also allows you to scale up your business if things go well. It’s the idea that you can repeatedly have the same clients spend money with you.

How Recurring Revenue Works?

The most common example of recurring revenue is a subscription service, where customers pay for regular access to a product or service. For example, Netflix offers monthly subscriptions for unlimited streaming video content, while Spotify offers subscriptions for unlimited music streaming. Other examples include:

- Insurance companies sell life insurance policies that provide coverage on an annual basis.

- News platforms such as CNN and New York Times charge users monthly fees for site access.

- Many online retailers offer “subscribe and save” options that allow customers to set up automatic monthly deliveries of products at discounted prices (e.g., Amazon).

How to Grow a Recurring Revenue?

Recurring revenue is the way to go if you’re just starting a business and looking for ways to grow it. Here’s how you can use this strategy in your business:

- Establish your value proposition. Before you can sell something on an ongoing basis, you need to know what value it offers your customers. Give them good reasons why they need what you’re selling before signing up for any subscription service with your company.

- Determine how much money it will take to keep a repeat buyer happy. When calculating the cost of running your recurring revenue program, you must factor everything from customer support to marketing costs to stay profitable over time (and don’t drain your bank account).

- Ensure there’s no upfront cost or risk for customers signing up for your service or product. It’s a lot easier for someone to commit to buying something if there’s nothing up front required from them.

- Give customers options. To ensure your customers are happy with their subscriptions, give them as many options as possible to customize their experience. For example, if you sell fitness DVDs through a subscription service, let customers choose which videos they want each month instead of renting all of them at once (which may not be possible).

- Build an email list. You can’t buy advertising if no one knows who you are, so building an email list is essential to growing a company through recurring revenue. You can send newsletters and promotions regularly or provide value by sending tips on using your products or services and other relevant information, such as industry news or updates on related topics.

Get the Upper Hand and Encourage Repeat Customers to Spend

Repeat customers should be the focus of all but the newest businesses. They bring in more revenue than returning customers and are only outclassed by loyal ones. However, all loyal customers will start by being repeat customers.

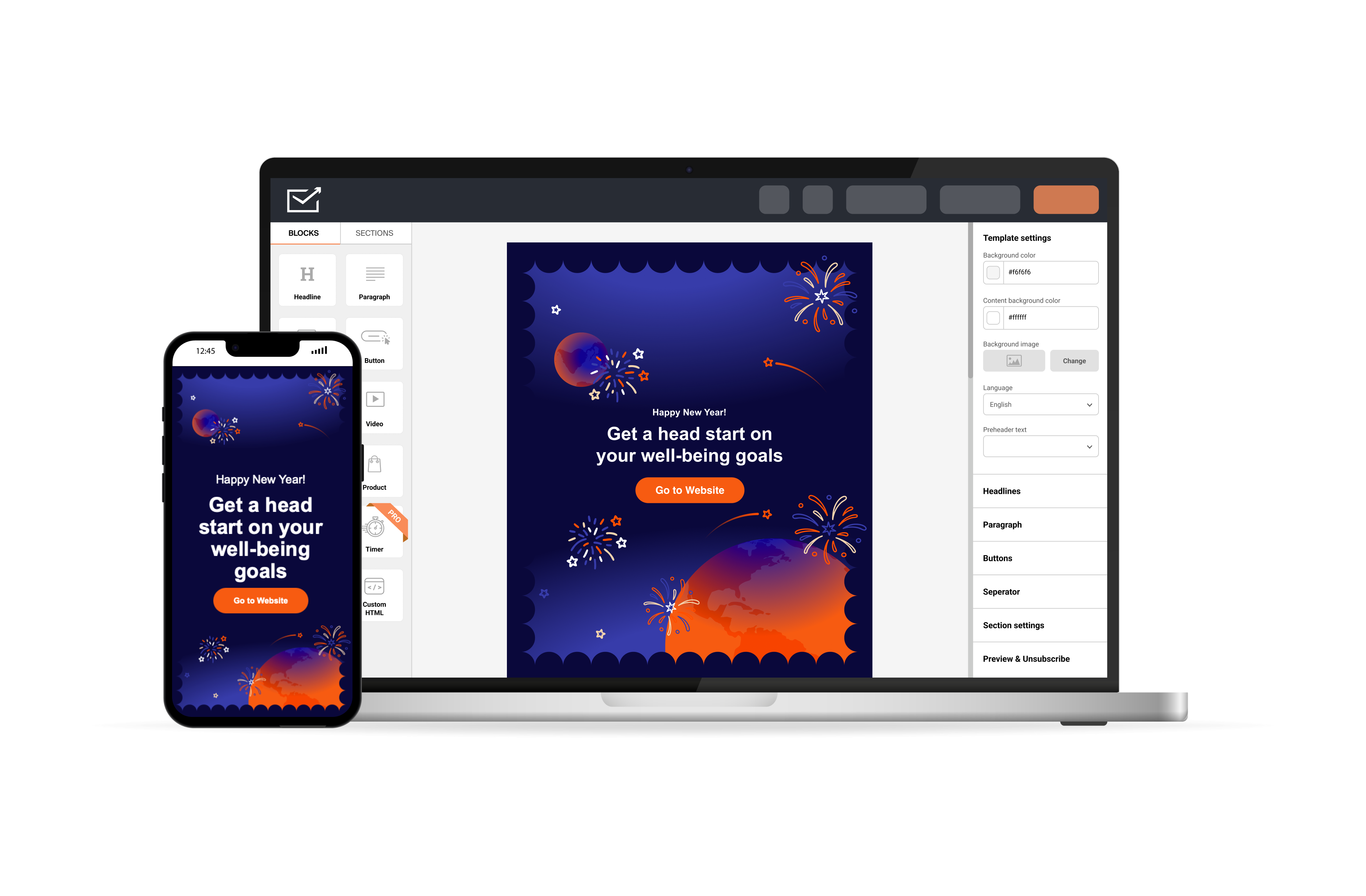

Want to use triggered emails to improve your chances of improving your repeat customer rate? Use Sender to automate your email campaigns and send triggered emails without hassle.

Also read:

- What is a Prospective Customer? Definition, Examples

- What is Customer Segmentation? Definition, Examples & Tools

- What is Promotional Marketing? Definition, Examples, Ideas

*Sources

- https://antavo.com/wp-content/uploads/2021/12/Global-Customer-Loyalty-Report-2022-by-Antavo.pdf

- https://emarsys.com/app/uploads/2023/03/ebook-The-Omnichannel-Guide-to-Retention-and-Loyalty-1.pdf

- https://emarsys.com/learn/white-papers/the-omnichannel-difference/

- https://www.invespcro.com/blog/customer-acquisition-retention/

- https://www.business.com/articles/returning-customers-spend-67-more-than-new-customers-keep-your-customers-coming-back-with-a-recurring-revenue-sales-model/

- https://www.wordstream.com/blog/ws/2020/01/08/reduce-churn

- https://www.huffpost.com/entry/50-important-customer-exp_b_8295772

- https://www.docsend.com/blog/reduce-churn-rate/

- https://www.forbes.com/sites/insights-treasuredata/2020/03/10/7-steps-for-creating-an-ideal-customer-experience-strategy/?sh=f6aef4a1b62c

- https://www.zendesk.com/in/blog/why-companies-should-invest-in-the-customer-experience/#georedirect

- https://www.revechat.com/blog/bad-customer-service/

- https://www.huffpost.com/entry/50-important-customer-exp_b_8295772

- https://www.forrester.com/report/2018-Customer-Service-Trends-How-Operations-Become-Faster-Cheaper-And-Yet-More-Human/RES142291

- https://www.gartner.com/en/customer-service-support/insights/customer-loyalty

- https://www2.deloitte.com/cz/en/pages/deloitte-analytics/solutions/customer-retention.html

- https://media.bain.com/Images/BB_Prescription_cutting_costs.pdf

- https://explodingtopics.com/blog/customer-retention-rates

- https://www.retailcustomerexperience.com/blogs/why-personalization-is-key-for-retail-customer-experiences/

- https://blog.smile.io/repeat-customers-profitable/